January 26, 2021

Other Analysis:

A Fundamental Disconnect

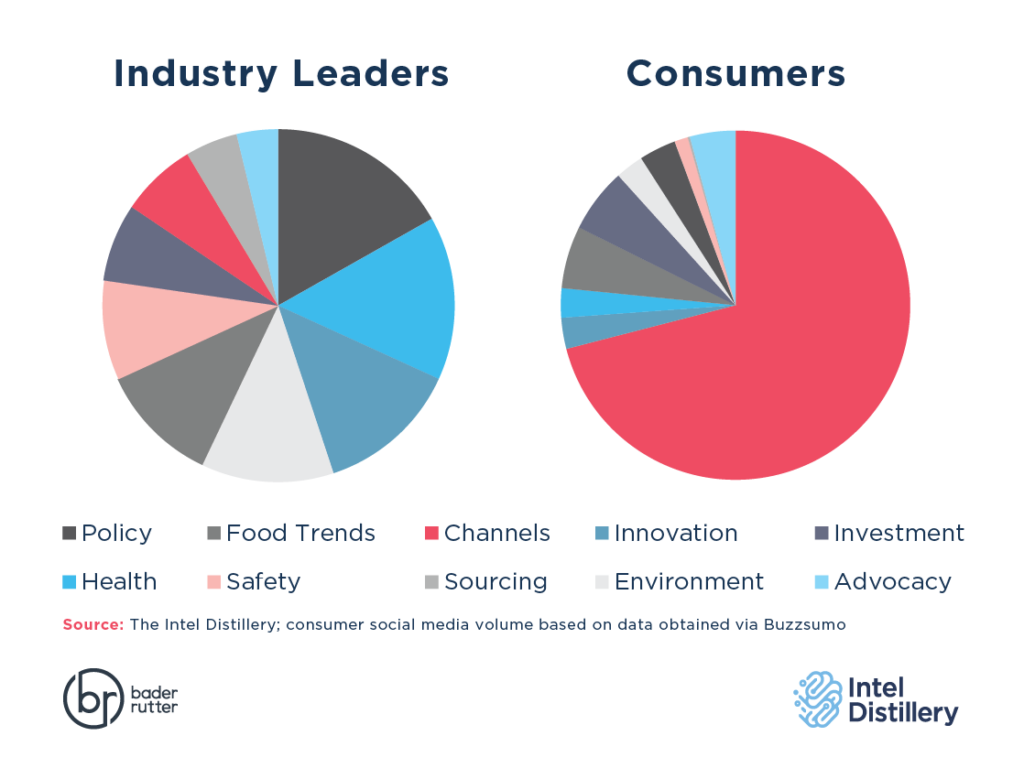

Depending on what conversations you’re following, there’s a fundamental disconnect in discussions about alternative protein. When it comes to meat alternatives, leaders from across the food chain have vastly different communications priorities than consumers.

Basically, industry leaders spread their attention across a diverse range of interests, while consumers focus predominantly on foodservice and retail channel availability.

Looking back at data spanning 2020, The Intel Distillery found that industry leaders split their attention relatively evenly across 10 topics. Policy, innovation and safety are production-side issues that the industry should naturally give more attention than consumers would. The next-most discussed issues surround consumer benefits: healthfulness, environmental impact and trendiness of the products.

Meanwhile, consumer conversations focused on when and where to find the products. Intel Distillery queries of Buzzsumo’s social media data indicated that consumers most frequently discussed news of new product availability. How to find the products garnered more attention than why.

Therein lies the opportunity: If alternative meat brands seek to resonate with consumers, they will need to talk more about their availability and through which channels. Answering questions like “where can I buy” or “what new products launched” are prime pain points to address for consumers and will contribute to brand-specific mainstream conversations on social media.

This content was developed in partnership with Alt-Meat, a multimedia brand covering a myriad of topics in the meat alternatives market from a business point of view. For more information, visit Alt-Meat.net.

A Word on Methodology

Meat alternatives in food production have proven to be one of the most provocative and abundant topics in recent years. Though the intensity of this topic subsided slightly to address pandemic-related urgency, debates rage on about the safety, labeling, nomenclature, regulation, and consumer acceptance of plant-based meat alternatives and their cell-cultured counterparts. At the request of the editors at Alt-Meat, we are pleased to help readers cut through some of the clutter and understand trends in these conversations. We will do this by comparing conversation volume between consumer voices and industry leaders.

We’ll first compare industry leader conversations with consumer social media activity, covering 2020 as a whole. Moving forward, we’ll alternate analysis between this comparison and more focused reviews of industry leader discussions. We hope you gain an understanding of industry leaders’ priorities and what’s trending in this important conversation.

Bader Rutter maintains a database of the 1,500 most influential voices throughout the food production continuum. The agency’s Intel Distillery team monitors, analyzes and ranks the topics important to these voices in order to provide a wide perspective of the most pressing topics in the food and ag industry.

When analyzing industry leaders’ conversations, we identified 10 key categories of talking points for alternative proteins. These categories help to understand industry priorities for producing and marketing the products.

- Advocacy captures activist attention to production issues as well as special interest groups that focus on “consumer rights” interests.

- Channels represents foodservice and retail availability, sales and marketing.

- Environment addresses carbon footprint, land use and water use in the production process.

- Food Trends covers protein products’ place in popular culture, from common diets to haute cuisine.

- Health includes nutritional benefits of the products, as well as associations between protein products and long-term conditions.

- Innovation accounts for research and development of new ingredients and products in the alternative protein market.

- Investment is our catchall for venture capital stakes, new production facilities, mergers and acquisitions.

- Policy covers regulation and legislation of meat alternatives, as well as legal challenges to those rules.

- Sourcing accounts for where ingredients come from, most frequently as part of corporations’ environmental, social and governance (ESG) goals.

Related Articles:

Food & Ag on the Ballot – 2024

Other Analysis | October 24, 2024

Nothing impacts the trillion-dollar food production industry as immediately as U.S. federal government decisions and policies. With a contentious national ...

Alt. Meat Leaders and Losers — January 2022

Other Analysis | January 27, 2022

Taking Stock of Sourcing PrioritiesOver the past month, the leading voices in food production took time to reflect on the ...

Alt. Meat Leaders and Losers — November 2021

Other Analysis | November 23, 2021

Sourcing Concerns Hit on Two-thirds of ESGIn the past month, influential figures in alt. meat production devoted their attention to ...

Alt. Meat Leaders and Losers — October 2021

Other Analysis | October 26, 2021

Ingredient Choices Impact the Bottom LineLofty brand ambitions don't matter if your supply chain can't back it up. The alternative ...

Alt Meat Leaders and Losers – September 2021

Other Analysis | September 28, 2021

A Long Fuse is Lit: Labeling Looms LargeInfluential conversations about cell-cultured products took a turn in September as labeling policies ...